UPI integration spurs growth in Rupay Credit Cards, says Kiwi report

Kiwi achieves a milestone of on-boarding 1 Lac Virtual Rupay Credit Cards in less than 10 months

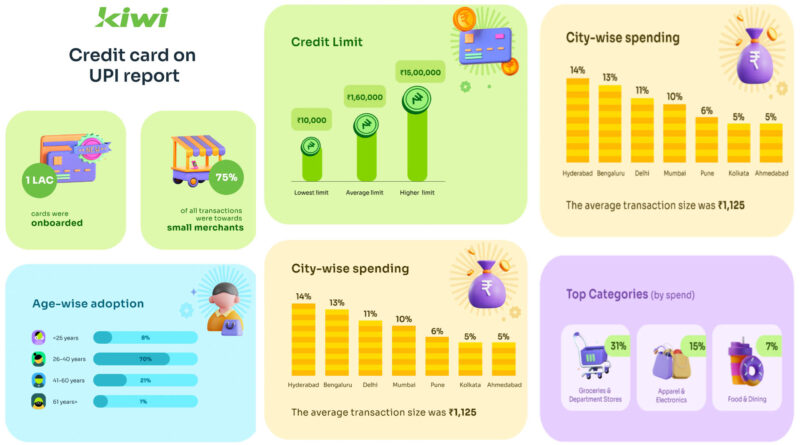

75% of all ‘Credit Cards on UPI’ transactions are happening at small merchants

Bengaluru stands second after Hyderabad in credit card on UPI usage, with 12% of onboarding and 13% of spending

Bengaluru, May 23, 2024: Kiwi, India’s pioneering credit-on-UPI platform, today released its latest report revealing insights into the nationwide surge in virtual credit card adoption through UPI integration. The company achieved a milestone by onboarding over 1 lakh virtual Rupay Credit Cards on the platform in less than 10 months. Bengaluru stands second after Hyderabad in credit card on UPI usage, with 12% of onboarding and 13% of spending.

The report titled ‘Credit Cards on UPI’ highlights a significant trend: More than Rs. 100 crore worth of Credit Card on UPI transactions are happening on Kiwi’s platform on a monthly basis. Furthermore, 75% of all these transactions occur at small merchants, showcasing widespread acceptance and utilisation of credit card payments. According to RBI data (as of April 2024), there are about 320 million merchant acceptance touchpoints for UPI payments, far surpassing the 9 million POS terminals available for credit card payments. This broad network, coupled with convenience, has driven the rapid growth of ‘credit cards on UPI’ over the past year.

The adoption of ‘Credit Cards on UPI’ was highest among young adults below 40 (78% of the users). CC on UPI has become the primary mode of payment, with users spending more than Rs. 22,000 every month. The average number of transactions using a CC on UPI is 21 per month, which is four times that of a traditional physical credit card.

The report notes that the average transaction size for ‘Credit Cards on UPI’ users is Rs. 1,125, significantly lower than traditional credit card transactions, which average around Rs. 4,000. Additionally, the data showed that grocery and Kirana stores were frontrunners in embracing ‘Credit Cards on UPI’ (constituting 33% of total usage), followed by apparel and electronics (15%) and food and dining (7%). The remaining 45% of expenses are spread across e-commerce, travel, government services, fuel, pharmacies, etc. This signifies the growing reliance on digital payment solutions for not only discretionary expenses but also daily expenses.

Kiwi Co-founder Mohit Bedi said, “Rupay Credit Cards’ market share has grown from 3% in FY23 to 10% in FY24. This success can be largely attributed to UPI’s success. Being a frontrunner in issuing Rupay credit cards, we at Kiwi are thrilled to see the swift adoption and usage of Rupay’s ‘Credit Cards on UPI,’ especially for essential spending. The concept of virtual credit cards has picked up exponentially. Nearly 20 out of every 100 credit cards being issued in the country are virtual credit cards.”

“Our ‘Credit Cards on UPI’ report signifies that ‘CC on UPI’ is pushing merchants and card users towards mindful credit card use. This will empower creditworthy individuals across the country to establish and strengthen their credit profiles,” Bedi added.

Backed by NPCI, Kiwi offers ‘Credit Cards on UPI’ in partnership with banks. Kiwi was co-founded by senior fintech experts and banking industry veterans, Siddharth Mehta (ex-CEO, Freecharge), Mohit Bedi (ex-Axis Bank and PayU) and Anup Agrawal (ex-business head, LazyPay), in November 2022. The company went live with its first banking partner, Axis Bank, in July 2023.