SAMCO MF Launches Multi Cap Fund with unique 4-in-1 strategy

· NFO Opens on October 10, 2024 and closes on October 24, 2024

· SAMCO Multi Cap Fund is built with 4-in-1 strategy to improve the risk adjusted returns for the capital deployed, strategy distributes capital evenly across 4 categories: 25% for Large caps, 25% for Mid-caps, 25% for Small caps and 25% for Smaller Companies beyond Nifty500

Bengaluru: SAMCO Asset Management Private Limited, a distinguished investment management firm, today announced the launch of the Multi Cap Fund. This unique fund is designed to provide investors with an extra alpha generation opportunity through a strategic approach. The fund incorporates a Smaller Cap Allocation for potential growth, Stock Selection using a proprietary model, Hedging in periods of downtrend to mitigate risks, and Dynamic Rebalancing to optimize performance across market cycles. The New Fund Offer (NFO) opens for subscriptions on October 10, 2024, and will close on October 24, 2024.

In the industry, Multi Cap funds typically follow an allocation of 50% to large-cap stocks, 25% to mid-cap, and 25% to small-cap, as guided by the Nifty500 Multi-cap 50:25:25 benchmark. However, SAMCO’s Multi Cap Fund sets itself apart by offering a more flexible and dynamic approach. It goes beyond the traditional stock basket by investing 25% exposure in small-cap stocks outside the Nifty500 during emerging opportunities. Additionally, during uncertain market conditions, the fund has the ability to shift allocations towards debt or arbitrage strategies, enhancing risk management and optimizing returns.

Commenting on the launch, Viraj Gandhi, CEO of SAMCO Asset Management Private Limited, said, “The launch of our Multi Cap Fund marks a significant milestone in our journey to offer innovative investment solutions. We believe this fund addresses a crucial need in the market for a strategy that can dynamically navigate across market capitalization while maintaining a strong focus on risk management. Our aim is to provide investors with the potential for long-term wealth creation while being mindful of downside protection.”

The Multi Cap Fund category is one of the fastest-growing segments in the mutual fund industry. The category has seen the growth of 84.54% over the last three years. This category offers diversification across market capitalization, making it an ideal choice for investors looking to invest in equities for the long term. With its broad-based exposure to large-cap, mid-cap, and small-cap stocks, Multi Cap diversification provides the potential for consistent returns over an extended investment horizon.

Umeshkumar Mehta, Chief Investment Officer (CIO) of SAMCO Asset Management Private Limited, added, “Our Multi Cap Fund’s investment approach is backed by rigorous research and a data-driven methodology. We’ve designed a robust framework that enables us to identify opportunities across the market spectrum – from large caps to small caps and beyond Nifty 500. What sets us apart is our ability to dynamically adjust our equity exposure based on market conditions, as evidenced by our track record of reducing exposure during significant market downturns. This strategy aims to help investors participate in the growth potential of various market segments while managing volatility.”

The SAMCO Multi Cap Fund utilizes a sophisticated drawdown management strategy that has demonstrated reduced equity exposure during major market downturns. This dynamic investment strategy allows for flexible asset allocation, adjusting exposure across market caps based on market conditions and opportunities.

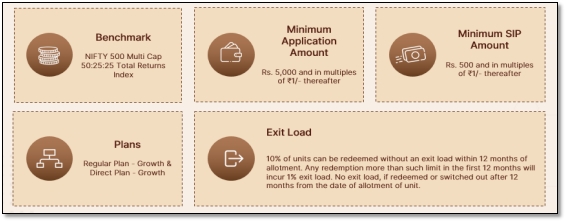

Salient Features:

The fund distinguishes itself through a comprehensive market approach covering multiple market segments, active risk management, and the ability to identify and invest in opportunities beyond traditional index constituents. The fund’s model has demonstrated superior drawdown management compared to the NIFTY Multi Cap benchmark during historical market downturns, showcasing its commitment to protecting investor capital while seeking growth opportunities.