Nifty Expected to Reach 26,889 by December 2025: PL Capital

PL Capital, one of India’s most trusted financial services organizations, has raised its 12-month Nifty target to 26,889, valuing the NIFTY at a 2.5% discount to 15-year average PE at 18.5x. The brokerage believes that domestic-oriented sectors like domestic pharma, select staples, Banks, capital goods, defense, and power will outperform in the near term.

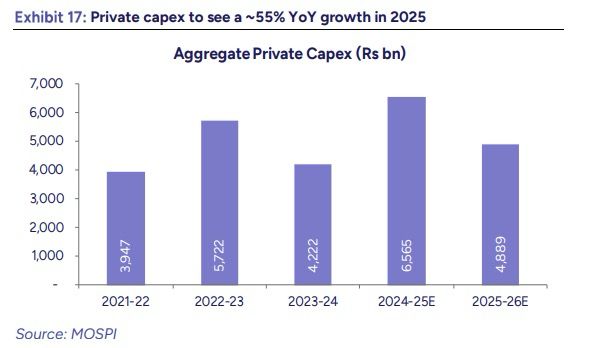

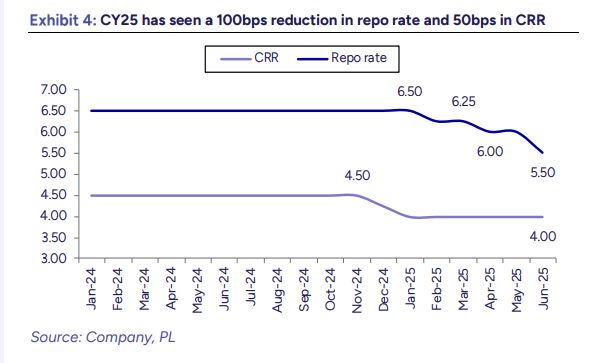

The brokerage highlights a multi-faceted recovery in domestic demand, supportive monetary policies, and focused fiscal initiatives as key drivers of growth. Festival season (Aug-Oct) is expected to catalyze broader consumption recovery, supported by stable inflation and improved consumer sentiment. Private Capex is expected to accelerate, driven by manufacturing investments.

India’s inflation trajectory has witnessed a sharp and sustained improvement over the past year, largely driven by a significant decline in food prices. Headline Consumer Price Index (CPI) inflation fell to 2.1% in June 2025, its lowest level in over three years. Food inflation turned negative (-1.1%) in June 2025 due to better crop arrivals, buffer stock releases, and easing global prices.

PL Capital believes domestic-oriented sectors will lead the next leg of market performance and is overweight on Banks, Healthcare, Consumer, Telecom, and Capital Goods, while remaining underweight on IT services, cement, metals, and oil & gas. In large caps, PL maintains positive views on ICICI Bank, Bharti Airtel, Hindustan Aeronautics, ITC, Titan, and Kotak Mahindra Bank.

According to Amnish Aggarwal, Director- Research, Institutional Equities, PL Capital, “Although a broad-based recovery is yet to take hold, factors such as tax relief, normal monsoons, easing inflation, and lower interest rates are creating conditions for a consumption-driven rebound. Rural sentiment remains resilient, while urban sentiment is gradually improving, particularly in discretionary segments.”

PL Capital forecasts modest top-line growth of 2% for its coverage universe, supported by stronger gains of 15% in EBITDA and 15.6% in PBT. Excluding oil & gas, EBITDA and PBT are expected to rise by 10.5% and 7.7%, respectively.